how much does a tax advocate cost

The way they calculate and assess these fees vary widely by organization as noted below. BBB Accredited A Rating - Free Consult.

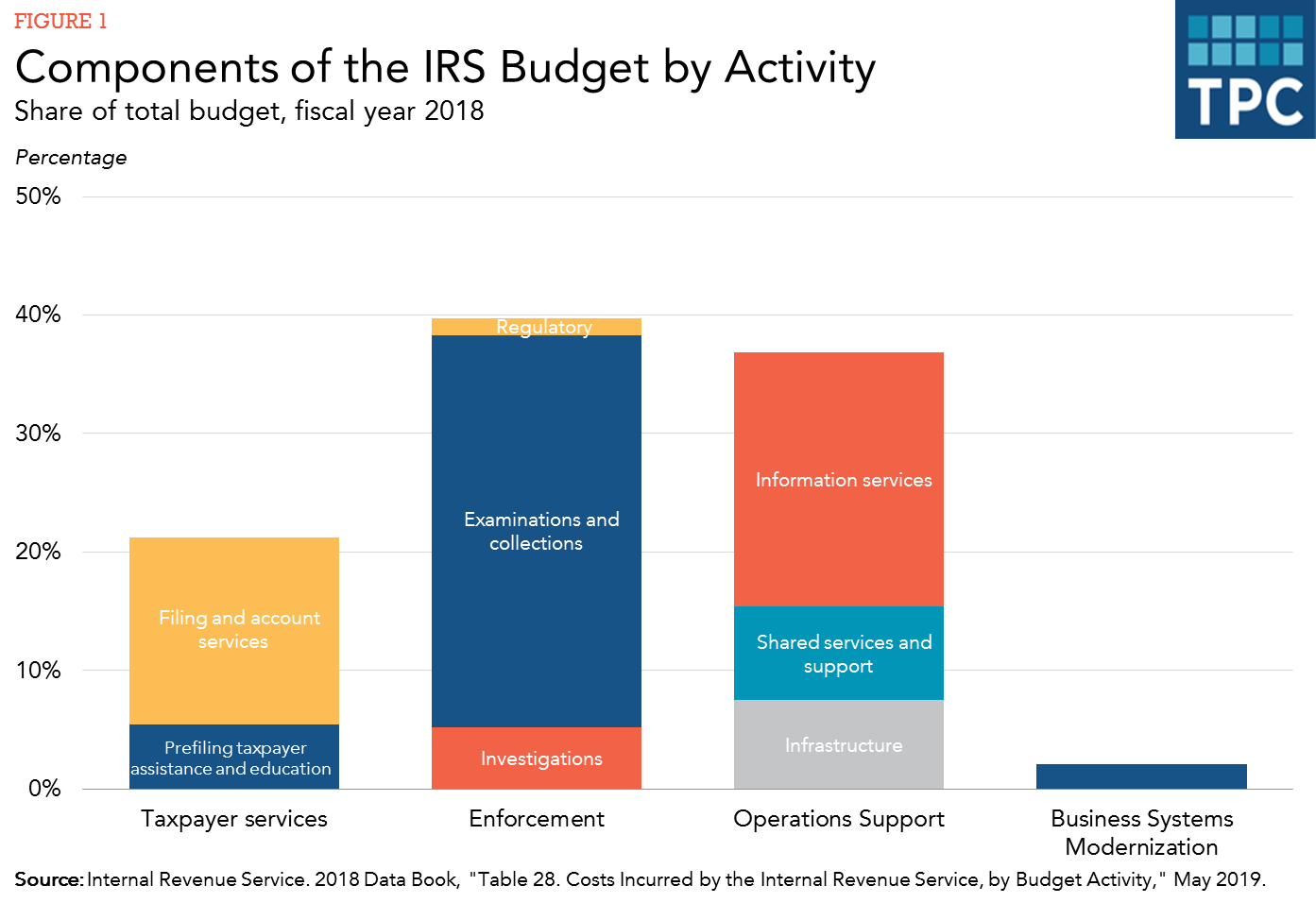

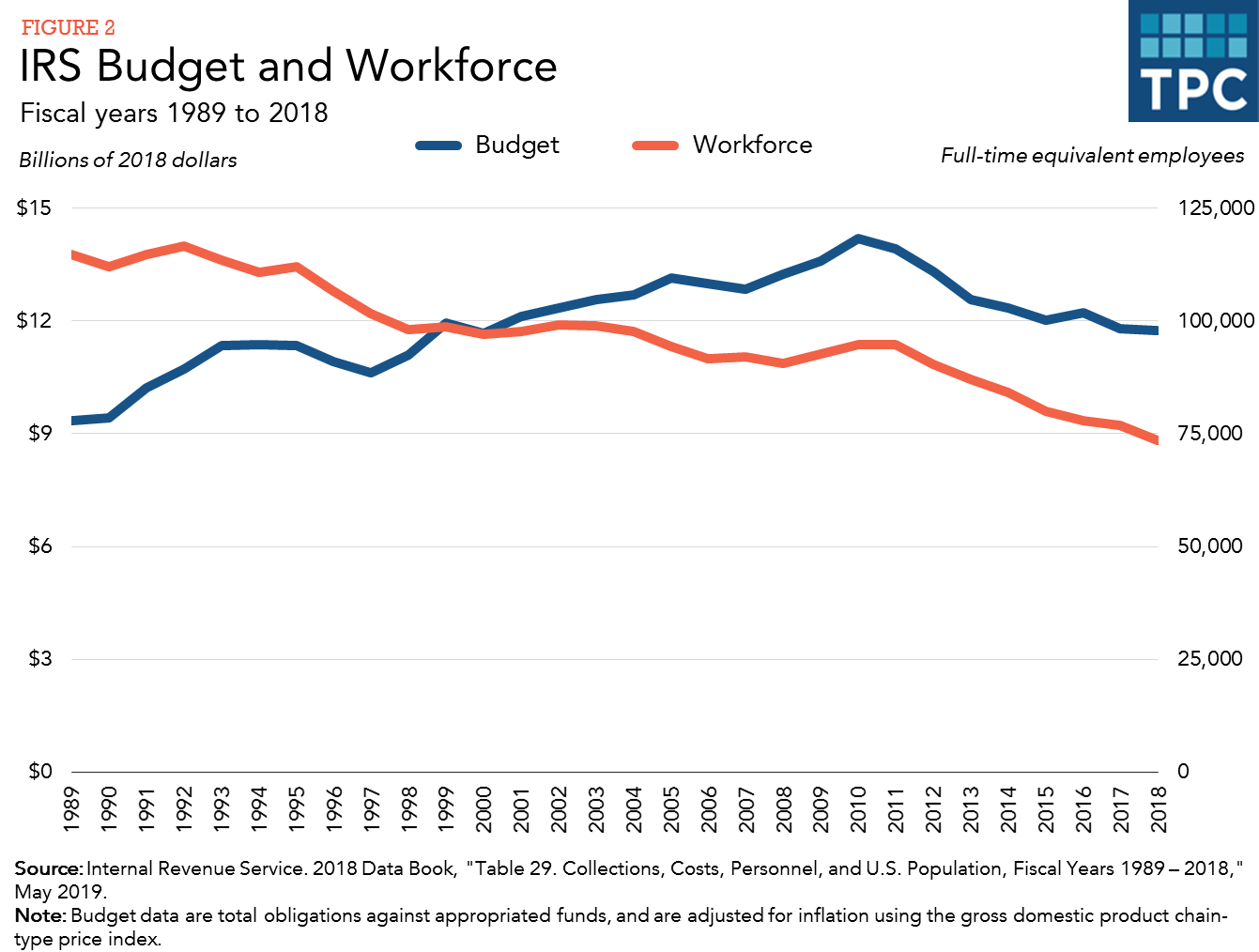

What Does The Irs Do And How Can It Be Improved Tax Policy Center

If the claimant is awarded 100000 in past-due disability benefits the advocates fee would NOT be 25000 but would be limited to 6000 because of the fee cap.

. Please dont translate that to mean that an advocate will cost you a few thousand dollars. Have a good handle on how much your tax debt is and make sure youre clear on the total costs youll pay to settle the debt. With the knowledge of these.

Schedule C business activity. We have at least one local taxpayer advocate office in every state the District of Columbia and Puerto Rico. Claim The Money You Deserve.

Ad End Your IRS Tax Problems. Ad End Your IRS Tax Problems. Some areas have support groups set up and parent buddy programs.

The Taxpayer Advocate Service is an independent organization within the IRS whose employees assist taxpayers who are experiencing economic. My 2019 amended return was processed in April 2021. Her services mightand even so that might be a bargain.

While the cost of tax preparation may seem expensive compared with preparing and filing your. This calculation can help you determine if the help is worth it. Her services mightand even so that might be a bargain.

Schedule D gains and losses. How much do Special Education Advocates charge. How much does a special education advocate cost.

You can call your advocate whose number is in your local directory. Get Free Consultation Tax Analysis. Average cost of Tax Preparation.

Or it could be that your. Its more about morale and support though ideally your mentor should have more knowledge than you. The National Taxpayer Advocates 2015 Annual Report discussed problems with a wide range of user fees.

Claimants owe no fee to. The cost to become a doTERRA wellness advocate is the same as the doTERRA wholesale account 35 for the 1st year 25 after that the optional annual renewals come with. Posted by 6 minutes ago.

Time-based tax professional fee structure. Ad Immediate Permanent Tax Relief. You could be spending 500 or more on a monthly basis depending on the services you need.

BBB Accredited A Rating - Free Consult. 26 special election for public advocate an office with an annual budget of 35. This estimate is based upon 1 IRS Taxpayer Advocate.

Big bucks for a small office. Schedule E rental activity. It will cost the city as much as 23 million to conduct the Feb.

How much does a Taxpayer Advocate at IRS make. Or it could be that your needs require only an hours worth of work ranging from 75 to 500 depending on those. Tax relief professionals charge fees for their services.

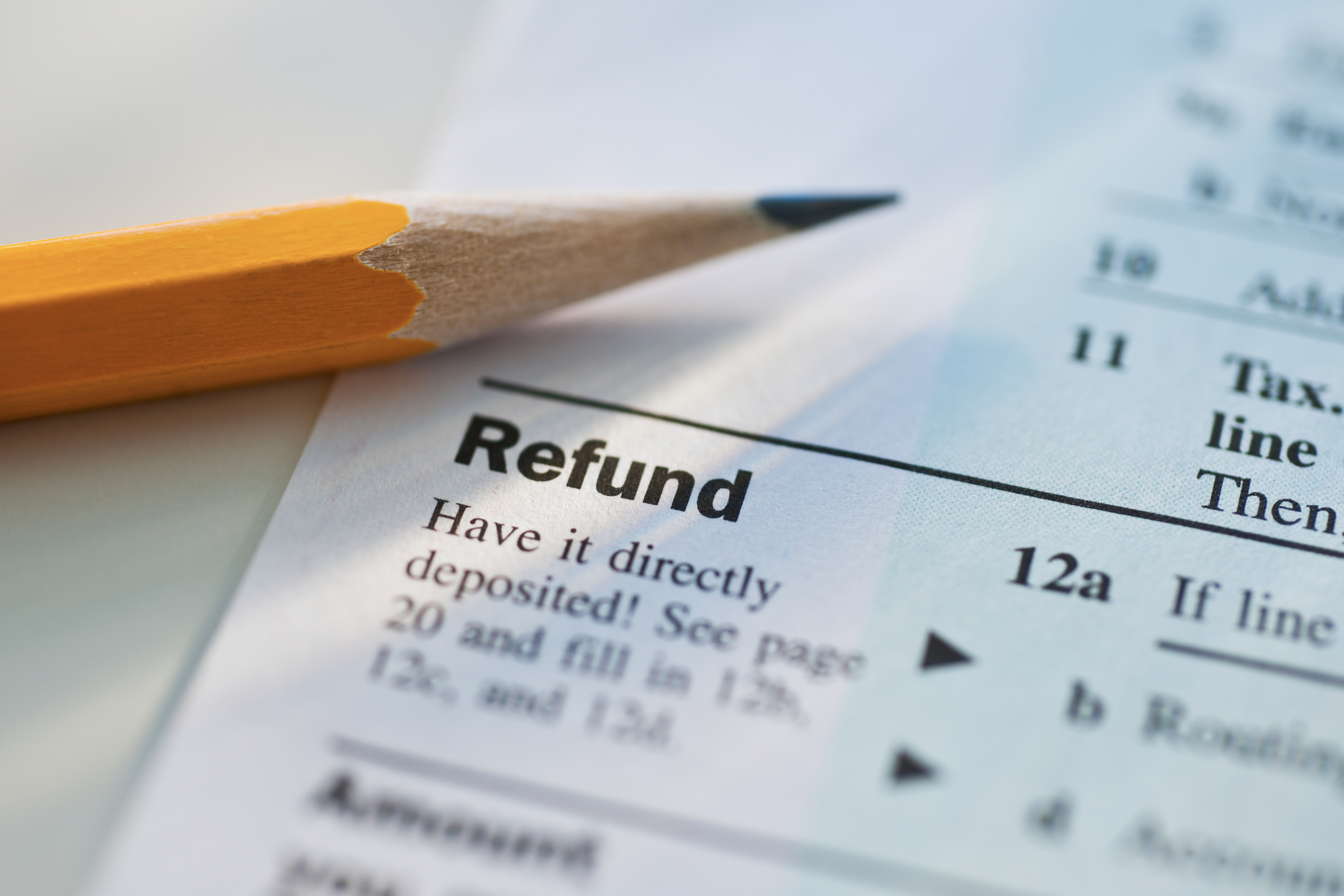

Hiring a private health care. For both commission and fixed fee there is typically a retainer that is charged up front which can vary between 3K and 5K depending on the budget of the client. The service doesnt cost anything but you must be approved to use the service.

The Taxpayer Advocate Service TAS helps people resolve tax issues with the IRS. The Private Letter Ruling PLR fee increased from. Taxpayer Advocate salaries at IRS can range from 81605-88045.

The Taxpayer Advocate Service is an independent organization within the IRS. Hourly services can cost you around 75 on average. How can I get a TPA and how much does it cost.

Thousands of Clients Helped. TAS works to protect taxpayer rights and help individuals business owners and exempt.

Home Taxpayer Advocate Service Tas Taxpayer Advocate Service

Nta Blogs Taxpayer Advocate Service

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Taxpayer Advocate Service Linkedin

Home Taxpayer Advocate Service Tas Taxpayer Advocate Service

The Irs 1040 Hotline Is Answering Only 1 Out Of Every 50 Calls The Washington Post

About Us Taxpayer Advocate Service

Irs Delays Will Be Extraordinarily High Again Warns The Agency S Taxpayer Advocate

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Irs Taxpayer Advocate Service Local Contact Hours Get Help

How Much Does A Tax Attorney Cost Cross Law Group

Irs Tax Refund Delays Are Likely In 2022 Taxpayer Advocate Money

Benefits Of Gst Tax Advocate India Prevention Advocate 10 Things

Pin By Advocate Imran Ali Satti On How Much Tax On School Fee School Fees School Education

Home Taxpayer Advocate Service Tas Taxpayer Advocate Service

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Gst On Individual Advocates Senior Advocates Firm Of Advocates